|

You might recall some of my plans for the year 2021 that I wrote about back in January. I shared about using each week to set goals, breaking down our big projects into smaller, manageable chunks -- instead of setting big annual goals that often seem unattainable. We are making good progress on several of our goals for the year, by taking an hour or two each week to work on them. Our detached garage/canning kitchen/man cave is almost finished. It's been a long process, but by knocking out a few tasks here and there each week, we're closing in on the finishing touches. We've done a lot of outdoor clean-up this year, by working for one Saturday a month or so to knock out some big areas of the property.

I wrote daily through March 8th and have 22,179 words in my first draft. My goal is to get to 60,000 words by the end of the year. I think that's still doable. I have six chapters finished, so far. 3. Blog Each Week. Well. This is only my 10th blog post of the year, so as you can see -- I'm a little behind on that. After spring break, school became a whirlwind and I just had to put something on the back burner. Unfortunately, it was blogging. I've got some catching up to do! :) 4. Lose 15 pounds. Following my experience with COVID-19 in September, I realized I had developed an allergy to dairy and sensitivity to gluten. Changing my diet to not include those things helped me to lose 15 pounds with no problem. I have slowly started introducing these things back into my diet and I will admit -- I don't feel as well. So I probably need to remove those things again. Whole30 coming again in August! 5. Read 40 books. As of last week, I had finished my 21st book and am almost finished with my 22nd and 23rd. So I'm right on schedule for the challenge.

Happy Almost August, Friends!

Taking in the last few days of summer break here at the farmhouse, Hannah ♥️🏡♥️

2 Comments

"I'm not a runner." "I'd rather sit on my couch." "Ha! The gym? Me? Riiiight..." This used to be how I talked about exercise. I used to joke about the fact that if people saw me running, they might want to run too because I was likely being chased by something scary. And then one day, with the encouragement of my sisters-in-law, I decided I might try it. I used the app "Couch to 5K" and I got to where I was able to jog a whole mile. It wasn't a fast mile, but it was more than I had ever been able to jog without stopping in my entire life. This was a huge accomplishment for me. Shortly after I built up this endurance, we found out we were expecting our third daughter. I was pretty sick for a little while and ended up giving up the running dream until after she was born. I was shocked at how much I missed running in those last few months of pregnancy. After I was fully-recovered from my caesarean section and able to leave her for a little while, I started jogging again. Between 2015 and 2018, I would run for a little while, then fall off the wagon. Repeat. Repeat. Repeat. My running commitment wasn't really a commitment, but more like a hobby that I would pick up every so often. Finally, in the summer of 2019, I really got serious about it and started doing a 5K each month. During the "Run for the Tree Kangaroos" race at the Kansas City Zoo in September, I injured my hip and had to take a pretty significant break. In March of 2020, just as COVID-19 was starting to make its rounds, I started taking daily walks to clear my mind after school. Being in school administration during a global pandemic is something that takes up a lot of headspace. These walks were mentally and emotionally healthy, but also started to bring back the positive feelings that I had associated with running in the past.

I love looking at the homemade medal hanger almost as much as I enjoy sifting through all of the medals for the races I did in 2020.

I've set a goal for myself of 20 5Ks in 2021, along with four 10Ks. Who knows? Maybe I'll work up to that half-marathon I've been dreaming about for the last few years. We'll see about the half-marathon, but either way -- today I can say with confidence, "I am a runner." Taking life one jog at a time here at the farmhouse, Hannah ♥️🏡♥️

I had found extra motivation by keeping track of the books I read in 2020 through the Goodreads Reading Challenge, so I was interested to see how this might transfer over to my other desired habits.

I decided to start tracking all of the goals I was working towards and see if I made more progress when I was monitoring. Sure enough, Gretchen Rubin was right. I started to track everything using a simple app called Done.

In the last few weeks, when I haven't felt like walking or drinking all of my water, this app has kept me on track.

Checkmarks on a scratch piece of paper could do the job, too. The point isn't the WAY you're tracking, it's that you make the effort to track. Tracking every day leads to streaks in certain habits. Streaks in certain habits leads to extra motivation to keep that streak going. I'm adding a new habit to my tracking list today -- blogging once a week. One week down. ✅ Monitoring my habits here in the farmhouse, Hannah ♥️?♥️

The book is basically the written version of the writing class Lamott teaches.

I've always felt the pull to write. Blog posts, song lyrics, short stories, poetry, letters, and someday -- a novel. So this is me committing to this idea in writing...to you. I want to write a novel. I've dreamed about it since high school. When I was teaching third graders about the writing process and helping them learn to become better writers, in the back of my mind, I was always composing my own stories. I have started so many times. I get through a few chapters or get through developing a character or two, and I kind of fall off of the wagon and halt the process. Six months later, I start again.

I'm giving myself the gift of done.

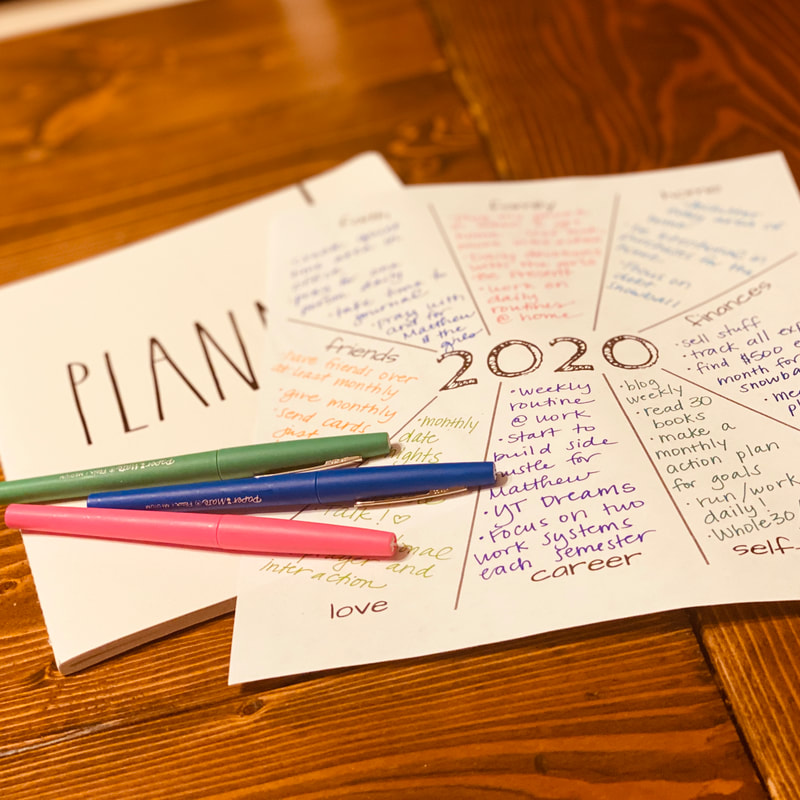

And hopefully, giving the world (or at the very least, my daughters) some sort of written gift in the process. Typing away here at the farmhouse, Hannah ♥️?♥️ Yesterday, I had a day of shopping with my mom and two of my sisters-in-law. On the way home, we stopped for coffee. Last night, we had a family Christmas and didn't get home until past 11:00 p.m. I got the girls to sleep and fell asleep myself around midnight...and was awakened by a five-year-old needing a drink about 3:00. The caffeine from the coffee must have kicked in about that time because it's now 6:00 a.m. and I haven't been back to sleep. Finally about 5:00, I decided to go ahead and get up and get the day started. I've been dreaming about 2020 ever since. Each year, about this time, I start to put together some goals and dreams for the new year. I used to be someone who came up with these elaborate plans for January 1st and crashed & burned by about January 5th. Over the last few years, however, I've really begun to focus on implementing some simple daily habits that will help me to make my long-term vision a reality.

Build a home my girls will look back on with fond memories. Build relationships with others that will lead to mutual growth. Build each other up. Continue to build a healthy marriage. I didn't set too many specific goals in these areas yet. I just took the time to write out some of my hopes & dreams for 2020. Some of the items on my list include projects, like creating a "quiet time" area in my office and making an action plan every month to mark off some of my "procrastination tasks". Some are daily habits -- working out every day, drinking enough water, planning healthy meals for my family, and reading my Bible & journaling my prayers. Some are just goals -- sending more personal cards via snail mail and being intentional in everything I purchase for our home. Are you ready to dream for 2020? This is the first step in building the life you want over the next twelve months. Feel free to download your own worksheet below and take some time to brainstorm today!

Up early, dreaming about the future here at the farmhouse,

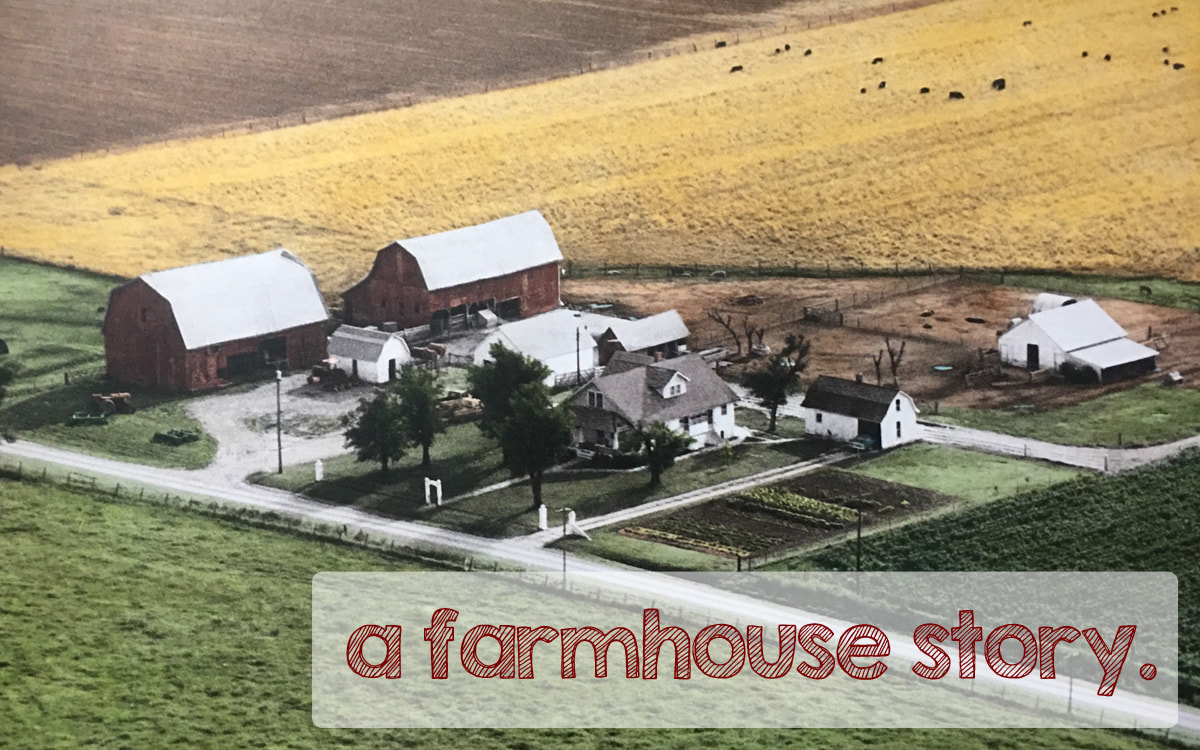

Hannah ❤️🏡❤️ In 2017, I started this blog when we bought the farmhouse. I so enjoyed sharing with my readers the transformation of certain rooms, as we moved in, painted, and even added a bathroom upstairs. I loved to share parenting stories, marriage joys & struggles, and decorating ideas. There were some weeks during the last year and a half that I was blogging every single day. Every. Single. Day. And yet, when I opened the blog today...my last post was in June. JUNE. That's SIX months ago.

However, a few days ago, I wrote a blog post to share as a guest writer on our minister's blog.

And it sparked something in me. I realized how much I had missed sharing in this way. Blogging feeds my soul. So in 2020, I'm committing to a weekly blog post. Not only to pour into my readers' lives...but for myself. Happy Last-Week-of-the-Decade, friends. Love from the Farmhouse, Hannah ❤️🏡❤️

Secondly, we have dirty clothes strewn throughout the house. It's like the children get dressed in every corner of the house. And of course, Mr. Farmhouse sometimes drops his dirty clothes DIRECTLY beside the hamper.

And finally...we haven't built a laundry habit that includes at least one load a day. Until now. As part of the 12-week challenge, I chose my January daily habit to be one load of laundry a day...from start to finish. Through the washer, through the dryer, folded, AND put away. Last fall, I started to make my bed every single morning. Even if I got nothing else accomplished during the time I had before leaving for work, I still made my bed. And now...I don't even have to think about it. Since starting the "one load a day" laundry habit, although I can't say I'm to the point where I'm doing laundry automatically, I can definitely notice a huge difference. In fact, I only have one load that could even be done right now because we're all caught up on the rest of our clothes.

Using the insight I gleaned from these authors, I have set up a 12-week challenge to set goals for the first twelve weeks of 2019, to keep myself accountable, and to check my progress throughout the next three months.

After setting up my goals and weekly challenges, I thought to myself that maybe you all would want to join me!

Excited for the new year here at the farmhouse,

Hannah ❤️?❤️ The Saturday before the new year. Historically, this is the day where I lay out my vision and goals for the year to come. I officially decide on my "word for the year" and start to build some specific goals around that word. The last three years, my words (phrases) have been "simplify", "be intentional", and "be present". This year, I've had four words that keep coming up as possibilities.. Gratitude. Grow. Joy. These are all wonderful words. They encompass all that I want for myself and my family. And as I have written these goals out on paper and dreamed about what my life will look like in December of 2019, one year from now, I am realizing that all of my goals revolve around inspiring others to live their best lives.

So...I think that's it. My 2019 Word of the Year...Inspire. Setting goals and making plans at the farmhouse on this final Saturday of 2018, Hannah ❤️🏡❤️

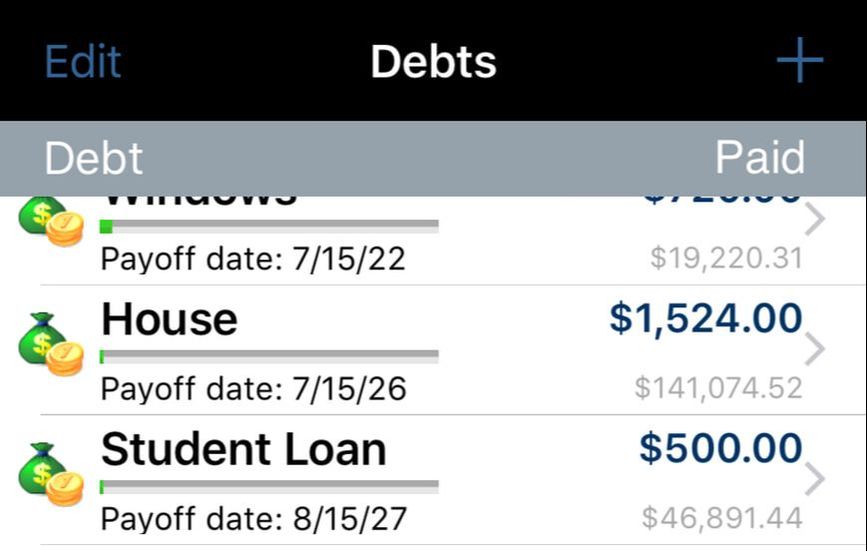

Like LITERALLY a week and a half ago, our checking account was OVERDRAFTED by over $1,000. True story. I had gone into the ol' Dollar General to grab a few gifts for the girls' friends. I went up to pay and when I ran my debit card, it was declined. "What!?! That can't be right. Try to run it again." Declined. Again. Sure enough, I pop open my banking app on my phone and we are in the hole...like WAY in the hole. But why? We track our spending and I watch the bank account like a hawk. So what had happened that day that put us in the red??? Well, when two mortgage payments come out two days before pay day, THAT can be an issue when you stick to a zero-based budget every month (in other words, when you budget for and spend every dollar, in order to pay down debt). So I went through that entire evening and the next morning feeling sick, just waiting for the bank and our mortgage company to open so I could make some phone calls. Our bank was very understanding and said they would wait to hear from me after I talked to the mortgage company. When I finally got through to the mortgage company, the sweet lady on the other end of the line was very confused because we had never been late on a payment. In fact, we were running a month ahead. She couldn't understand why the payment would have auto-drafted twice. So she started scrolling through the previous months. And then...she saw it. Because we had paid a little extra each month, it had added up to a whole extra payment this month... and that whole extra payment went in two days before it was supposed to, which had put us a little bit too early on our payment schedule... which in turn caused the computer to put our ENTIRE payment amount on the principal, as opposed to counting as our payment... SO the mortgage company had auto-drafted our December payment in addition to the one we had already paid because it looked like we hadn't paid! They fixed it and refunded it (two days later), but it was a stressful few days there! But at least there was a logical explanation. I would love to go explain to the Dollar General clerk exactly what happened because I'm sure he thought I was ridiculous trying to look at my bank account right then and there and over-explain the reason my card was declined. Maybe he'll read my blog. 😉 ANYway, now that I've gotten that off my chest, let's talk about how Mr. Farmhouse and I set up our annual financial goals, our debt snowball, monthly budget, and spending tracking. Debt Snowball The first piece of the puzzle that I'm going to talk about is the debt snowball. I've mentioned this before, but I'll do a quick review for new readers. The debt snowball is based on the work of Dave Ramsey. You take all of your debts and you line them up from smallest balance to largest balance. Interest doesn't matter and monthly payment doesn't matter. It's all about small victories in this scenario...the motivation that comes from a little success. As you pay off the smallest debt, you take that monthly payment and "roll" it into the next payment. I really don't like to talk about the specifics of finances, but I will tell you that we have a large amount of debt. Some of our debt includes:

Just this, without the random little medical bills and the two credit cards we still need to pay off, is a pretty daunting amount. However, with the debt snowball, we are making big progress each month towards paying it down.

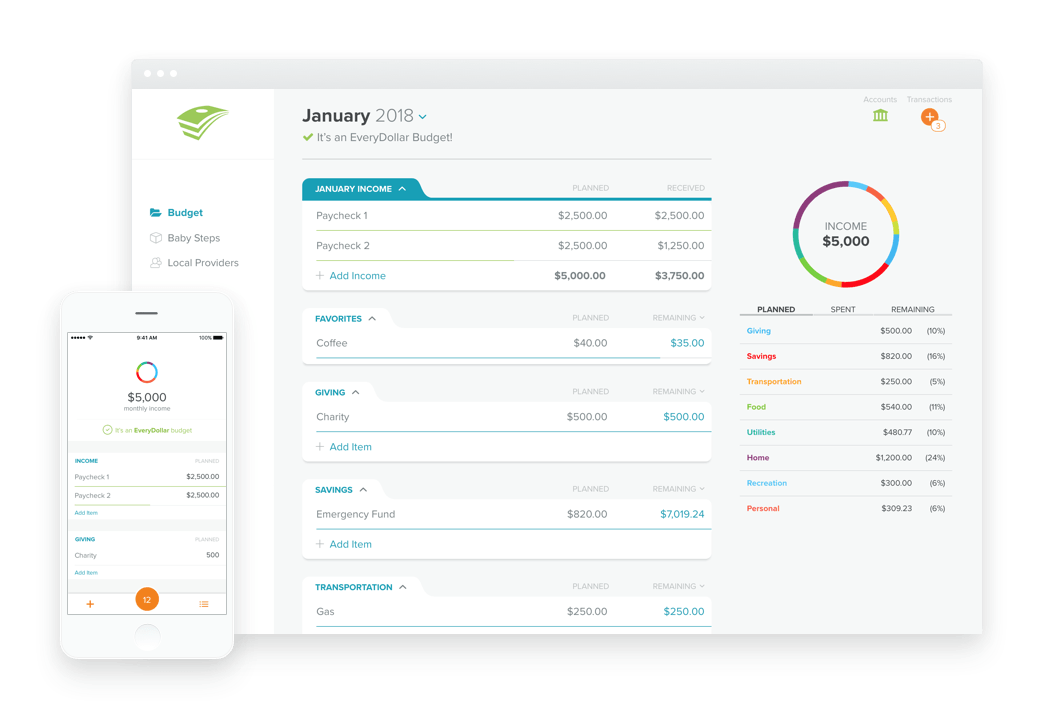

But as you can see, the house and student loans will be our last two debts that need to paid off and without ANY extra money thrown onto the snowball, we'll still be completely debt-free in less than ten years. So I use the snowball app to let me know how much needs to be paid on each debt monthly and those payment amounts fit into our monthly budget. Monthly Budget & Spending Tracking For our monthly budget, we use a free web-based software and app called EveryDollar. We build our budget every month on the computer, but we mostly track our spending using the app. The app syncs across all devices and the web, so it's pretty handy for a husband & wife team who hardly ever gets to sit down and talk about income and expenses. If you are just starting a new budget, I would first take a piece of paper and write down every single expense you have each month. Use your debt snowball to track your monthly debt payments, write out every utility amount, any insurance costs, groceries, fuel, home & car maintenance savings, other savings, charitable giving, childcare, costs associated with pets, business expenses, cash for spending on "fun" (Sonic drinks, in my case!), and anything else you can think of. After you have all of those items written down, start building your budget on EveryDollar. You'll need to write down expected income sources and amounts, as well as expected categories and amounts for expenses. Your online EveryDollar budget will look similar to this sample screenshot below.

Because we get four different paychecks each month, I divide our expenses up and pay them on those four days. We also take our "fun money" out of the bank on those days and account for daycare/preschool expenses, as well as putting money into various savings accounts using sinking funds, which I explained in THIS BLOG POST last year. I write out every expense on the planner. Most of them are automatic withdrawal, which means after I write them out on the calendar, I don't have to think about them again. If they're not automatic, however, I set up the payments to come out on the correct day or I write out the checks and date them to be sent when the correct pay period rolls around.

In terms of tracking other expenses, Mr. Farmhouse and I both use the EveryDollar app to track what we spend each month. We used to be good about putting each expense in right when we spent it. However, over the last few months, we have been tracking a few days worth of receipts in one evening. We're planning to go back to the daily tracking in January though! Those small expenses sure add up when you're not being cognizant of them! Annual Financial Goals The last little piece of the puzzle is to set some annual financial goals. We have found that if we sit down together in the end of December and set some financial goals for the following year, it can help to frame our year, financially speaking. A few examples of our past goals have been:

If we want to be able to give and live the way we want to in the future, we HAVE to be intentional right now...today...this year.

We've had times where we get to the end of the month and wonder where in the world all that money went. It's no way to live! When you're not being intentional with your spending, not only are you missing the opportunity to make progress on your debt snowball, but you're also missing out on that feeling of peace and freedom that comes from knowing where your money goes each month! Not to mention, the fact that these money conversations with your spouse are good for your marriage! So today...think about your financial goals for 2019. Budgeting & Planning here at the Farmhouse today, Hannah ❤️🏡❤️ |

Archives

January 2024

Categories

All

|

||||||||||||||||||||||||||||||||||||||

RSS Feed

RSS Feed