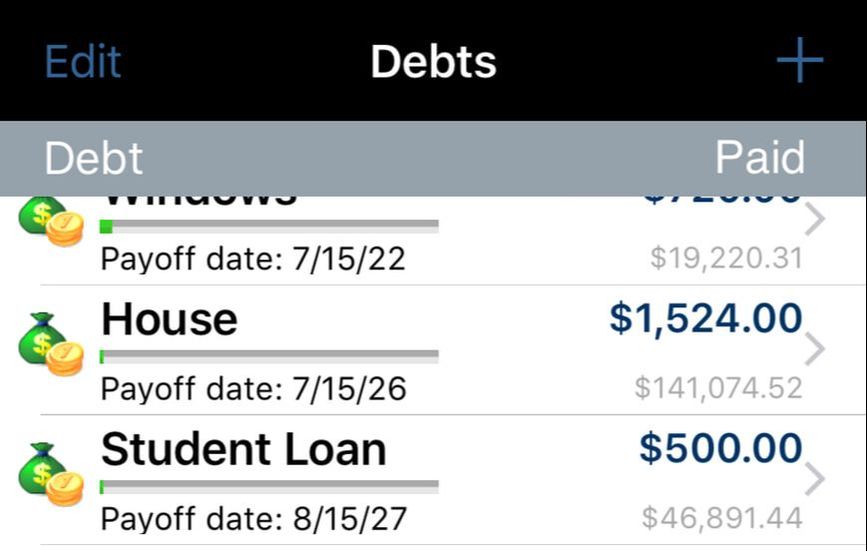

Like LITERALLY a week and a half ago, our checking account was OVERDRAFTED by over $1,000. True story. I had gone into the ol' Dollar General to grab a few gifts for the girls' friends. I went up to pay and when I ran my debit card, it was declined. "What!?! That can't be right. Try to run it again." Declined. Again. Sure enough, I pop open my banking app on my phone and we are in the hole...like WAY in the hole. But why? We track our spending and I watch the bank account like a hawk. So what had happened that day that put us in the red??? Well, when two mortgage payments come out two days before pay day, THAT can be an issue when you stick to a zero-based budget every month (in other words, when you budget for and spend every dollar, in order to pay down debt). So I went through that entire evening and the next morning feeling sick, just waiting for the bank and our mortgage company to open so I could make some phone calls. Our bank was very understanding and said they would wait to hear from me after I talked to the mortgage company. When I finally got through to the mortgage company, the sweet lady on the other end of the line was very confused because we had never been late on a payment. In fact, we were running a month ahead. She couldn't understand why the payment would have auto-drafted twice. So she started scrolling through the previous months. And then...she saw it. Because we had paid a little extra each month, it had added up to a whole extra payment this month... and that whole extra payment went in two days before it was supposed to, which had put us a little bit too early on our payment schedule... which in turn caused the computer to put our ENTIRE payment amount on the principal, as opposed to counting as our payment... SO the mortgage company had auto-drafted our December payment in addition to the one we had already paid because it looked like we hadn't paid! They fixed it and refunded it (two days later), but it was a stressful few days there! But at least there was a logical explanation. I would love to go explain to the Dollar General clerk exactly what happened because I'm sure he thought I was ridiculous trying to look at my bank account right then and there and over-explain the reason my card was declined. Maybe he'll read my blog. 😉 ANYway, now that I've gotten that off my chest, let's talk about how Mr. Farmhouse and I set up our annual financial goals, our debt snowball, monthly budget, and spending tracking. Debt Snowball The first piece of the puzzle that I'm going to talk about is the debt snowball. I've mentioned this before, but I'll do a quick review for new readers. The debt snowball is based on the work of Dave Ramsey. You take all of your debts and you line them up from smallest balance to largest balance. Interest doesn't matter and monthly payment doesn't matter. It's all about small victories in this scenario...the motivation that comes from a little success. As you pay off the smallest debt, you take that monthly payment and "roll" it into the next payment. I really don't like to talk about the specifics of finances, but I will tell you that we have a large amount of debt. Some of our debt includes:

Just this, without the random little medical bills and the two credit cards we still need to pay off, is a pretty daunting amount. However, with the debt snowball, we are making big progress each month towards paying it down.

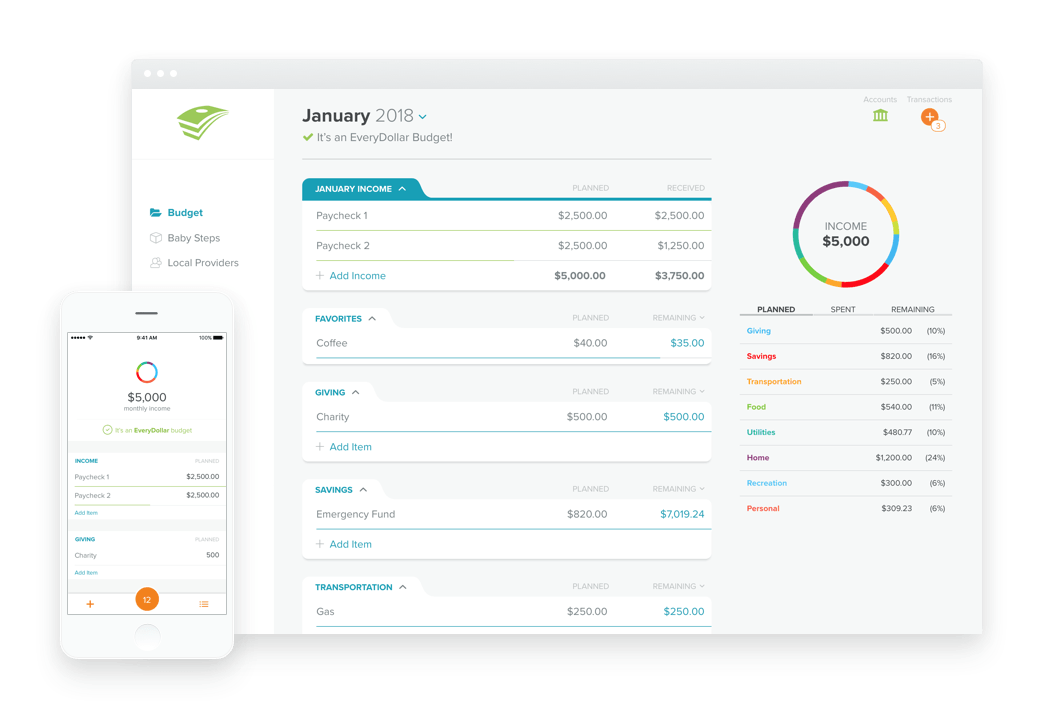

But as you can see, the house and student loans will be our last two debts that need to paid off and without ANY extra money thrown onto the snowball, we'll still be completely debt-free in less than ten years. So I use the snowball app to let me know how much needs to be paid on each debt monthly and those payment amounts fit into our monthly budget. Monthly Budget & Spending Tracking For our monthly budget, we use a free web-based software and app called EveryDollar. We build our budget every month on the computer, but we mostly track our spending using the app. The app syncs across all devices and the web, so it's pretty handy for a husband & wife team who hardly ever gets to sit down and talk about income and expenses. If you are just starting a new budget, I would first take a piece of paper and write down every single expense you have each month. Use your debt snowball to track your monthly debt payments, write out every utility amount, any insurance costs, groceries, fuel, home & car maintenance savings, other savings, charitable giving, childcare, costs associated with pets, business expenses, cash for spending on "fun" (Sonic drinks, in my case!), and anything else you can think of. After you have all of those items written down, start building your budget on EveryDollar. You'll need to write down expected income sources and amounts, as well as expected categories and amounts for expenses. Your online EveryDollar budget will look similar to this sample screenshot below.

Because we get four different paychecks each month, I divide our expenses up and pay them on those four days. We also take our "fun money" out of the bank on those days and account for daycare/preschool expenses, as well as putting money into various savings accounts using sinking funds, which I explained in THIS BLOG POST last year. I write out every expense on the planner. Most of them are automatic withdrawal, which means after I write them out on the calendar, I don't have to think about them again. If they're not automatic, however, I set up the payments to come out on the correct day or I write out the checks and date them to be sent when the correct pay period rolls around.

In terms of tracking other expenses, Mr. Farmhouse and I both use the EveryDollar app to track what we spend each month. We used to be good about putting each expense in right when we spent it. However, over the last few months, we have been tracking a few days worth of receipts in one evening. We're planning to go back to the daily tracking in January though! Those small expenses sure add up when you're not being cognizant of them! Annual Financial Goals The last little piece of the puzzle is to set some annual financial goals. We have found that if we sit down together in the end of December and set some financial goals for the following year, it can help to frame our year, financially speaking. A few examples of our past goals have been:

If we want to be able to give and live the way we want to in the future, we HAVE to be intentional right now...today...this year.

We've had times where we get to the end of the month and wonder where in the world all that money went. It's no way to live! When you're not being intentional with your spending, not only are you missing the opportunity to make progress on your debt snowball, but you're also missing out on that feeling of peace and freedom that comes from knowing where your money goes each month! Not to mention, the fact that these money conversations with your spouse are good for your marriage! So today...think about your financial goals for 2019. Budgeting & Planning here at the Farmhouse today, Hannah ❤️🏡❤️

0 Comments

2019 is coming. In fact, we have ONE WEEK left of this year. The day after Christmas is always when I really start planning and thinking specifically about the year to come. We take down our Christmas decorations and get the house "back to normal". I go through my calendar for the entire next year and fill in various events, reminders, and appointments. I sit down with a piece of paper and I start to dream about what's to come in the new year...things I want to accomplish, dreams I have, and specific goals. This week, I thought I would go through each piece of my planning process for anyone that wants to follow along. Some of the things I'll cover are:

One of my big goals for 2019 is to stay in touch with my readers more! So with that in mind, I've started working on an email list! I'm currently in the middle of a chat conversation with my email provider to figure out how to turn off my subscription form for those of you who have already subscribed...for now, just click the "X" when it pops up, if you're already a subscriber! Thanks in advance for subscribing and following along with us during the new year!

Prepping for 2019 at the farmhouse, Hannah ❤️🏡❤️ I have so many wonderful memories of Christmas morning as a child. There was the year that we woke up to 10-speed-bikes sitting in front of the tree, surrounding the rest of the gifts for my little brother and me. There was the year that it was snowy and cold and after all the gifts were opened, we both got carried outside with our eyes closed to find the playhouse they had ready for us. In fact, Mr. Farmhouse and I used that playhouse as our chicken coop until just last year when we moved to the farmhouse. There was the year that he and I peeked at our gifts and our two "big gifts" were missing on Christmas morning. My mom had saved them for last and had wrapped them up with our parents' names on the tags. We were trying to play it cool like we didn't know they were missing, because we didn't realize they knew we had sneaked out to the shop to look...lesson learned! Even into adulthood, we have always been provided with everything we ever dreamed of, so naturally I have wanted to provide the same feeling for my own girls. However, we have some financial goals that we are working towards to be able to provide for them later in life...in high school when they need a vehicle to drive, to help them with college expenses, and of course, when they get married and start having children. Going into debt or dipping into savings at Christmastime is tempting, but after working so hard for an entire year to save and work the debt snowball, we don't want to lose our progress at the end of the year because of gifts.

You guys.

I cannot even tell you how amazing the process has been. The girls couldn't even think of three items for each category. They were sitting together at the dining room table as they tried to think long and hard about what they truly needed and the conversation they were having warmed my heart. H: I can't think of anything for "something I need". I don't think I need anything. C: I put an electric toothbrush because mine broke a few weeks ago. H: You know, I will be needing a new softball glove this year. I'll put that on there. The girls are completely aware that we would buy toothbrushes or softball gloves during other times of the year, but instead of using that gift slot for something else, they both decided to use it to replace items that are worn out or too small. I was able to shop for the gifts without breaking the bank and literally all in one night (Black Friday with my sis-in-law!). They will each get stocking stuffers and one small gift from Santa and that is IT. The tree is still pretty. The farmhouse is still cozy. The magic of the season is all around us. With four gifts each. I can't wait to see their faces on Christmas morning. Happy December from the farmhouse, friends. ❤️🏡❤️

Back in January, I made the goal to read 30 books in 2018.

Well, it's mid-April and I am in the middle of books number SIX and SEVEN. Book number six is The 7 Experiment (Jen Hatmaker). And book number seven is The Principal: Three Keys to Maximizing Impact (Michael Fullan). I will post a completed list at year-end, but for today, I would love to talk to you about the book I finished just last week, The 12-Week Year: Get More Done in 12 Weeks Than Others Get Done in 12 Months (Brian P. Moran & Michael Lennington).

I immediately downloaded it and started listening to it that night.

Wow. The concepts in the book were so obvious and yet, I needed to hear them so badly. How many of us wake up on January 1st every single year with so many hopes and dreams for the year? We make goals (New Years' Resolutions, if you will), whether on paper or in our heads. There are so many things we want to accomplish by December 31st, and yet by the time February hits, adequate progress towards most of our goals has not been made. We don't have to work too hard in January and February because December is still SO...FAR...AWAY. We push through March and April, making excuses as to why we are not moving towards our goals. It's so cold. When it warms up, I will get to work on those goals. I promise! When the school year ends, I'll have so much more time to focus on my plans. There's still PLENTY of time to meet my goals before the end of the year! We're not even halfway through the year! May, June, and July come and go. The summer is just so busy. When school starts, I'll be able to focus more. It's too hot! Summer is for rest and relaxation. By the time we hit August and September, we are ready to get the kids back into the routine of school and get to work on those "New Years' resolutions"! But it's just crazy when everyone is trying to get back into the grind of school. On October 1st, it hits us...we only have three more months to reach our goals. We start to get a glimpse of the urgency that is needed if we're going to hit our goals before January 1st, but by this point...it feels like it's too late. We'll try again next year. I knew I couldn't continue this cycle forever.

With all of the changes coming in our life over the next six months, I knew that I needed to get it together.

I'll be starting a new job on August 1st and life will be different at the farmhouse at that time if we don't start to mark some things off of our giant to-do list. The basic premise of the 12-week year is that we get rid of our "annualized" thinking when it comes to goal-setting and working towards making our vision for our life a reality. We start to think of each 12-week section of time as a year. Instead of putting off tasks until the end of the year when the urgency starts to take over, we keep that sense of urgency year-round, while setting realistic goals and focusing on the execution of daily tasks to help us reach our desired result.

"If you want to know what your future holds, look at your current daily actions. Those are the best predictor of your future. Not your hopes and dreams and visions. Your daily action. Because daily action is what moves a person forward."

We can have the most well thought-out vision and the most wonderful plan in the world. However, if we don't execute well...none of that matters. So remember as you think about your vision, your goals, and your plan that we need to also think about the effectiveness of our execution. We have to DO the hard work every stinking day. Even when we don't feel like it. Just do it.

We are in Week 2 of our first 12-week year and we are LOVING the results we are seeing.

I'm going to take you through the process of how Mr. Farmhouse and I set up our first 12 weeks. This is, in no way, a substitution for you reading the actual book and following the plan. But I'm hoping it can at least inspire you to get started! 1. Write out your personal vision for your life 10 or 15 years down the road. Be specific! Close your eyes and picture the life you've always dreamed about! There's no goal too lofty. Just write it all down!

2. Based on that vision, think about what parts of that vision you could work towards for the next three years.

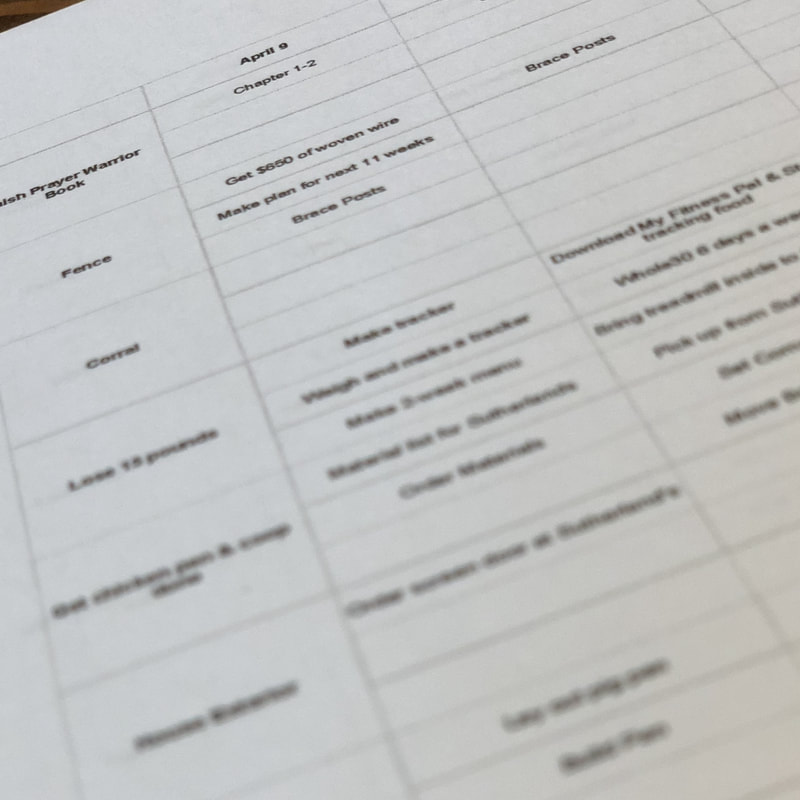

We are zooming in at this point. We're taking that lifelong vision and breaking it into more measurable and attainable chunks. We went through our vision and wrote some attainable goals. I'm not going to share every single part of our personal family vision because your vision should be your own. However, on our long-term vision, we wrote that we want to be completely debt-free in ten years. So for our three-year plan, we want to work towards having everything paid off except for the farmhouse and my student loans. 3. Based on your three-year goals, set goals for the next 12 weeks. We are zooming in even farther at this point. What can we do to move ourselves closer to meeting that long-term vision and that three-year goal in the next three months? At this point, we broke down our 12-week plan into fourteen very specific, small, and attainable goals.

It includes blogging goals, a plan to get my classroom completely cleaned out before I move into an office next year, and a plan for our first garden here at the farmhouse.

On this step, be specific. Be detailed. And be realistic. 4. Create a weekly plan including activity that needs to be completed every week to help you reach your goals. We did this on the Sunday evening before we started into our first week. These are very specific tasks that will move you toward your 12-week goals. Here's an example of this from our 12-week year. We want to finish the wall and closet for the fourth bedroom. During week 1, we needed to measure the closet and wall space and make a materials list. We needed to order the supplies from Sutherland's. These are the only two tasks for that goal that we could realistically finish in Week 1. But we finished those two tasks and moved farther along in the process than we have in the last six weeks. We aren't putting that task it off any longer because now it seems manageable. It seems attainable. We can do this! 5. Every single week, check your progress from the previous week and plan the next week. This part is crucial to the success of the 12-week year. What daily action did you carry out regarding each goal? How much progress did you make towards your goals? Were you diligent in doing the hard work every single day? If not...OWN IT and vow to do better this week! After checking your progress, make a new weekly plan! In the book, Moran talks about three different blocks of time we need to religiously schedule each week. Strategic Blocks - 3 hours of protected time early in the week where you knock out a lot of your weekly activity work (1 time per week) Buffer Blocks - 30 minutes to one hour blocks of time where you do those mundane yet necessary daily tasks like checking emails and social media (1-2 times per day) Breakout Blocks - 3 hours of time later in the week where you BREAKOUT of the work cycle and focus on pouring back into yourself (1 time per week) I tried this schedule this week and could not believe how much more I was able to accomplish during that first strategic block when I wasn't distracted by emails, my phone, or other daily (sometimes meaningless) tasks that I spend so much time on each week. Week 13.

Week 13 in the 12-week year is for reflection and celebration!

Because you're not thinking about the annual goals that are looming over you, you are able to be more focused on a few attainable goals and the tasks that will get you to the end result you desire. I would encourage you to grab the book or at the very least, try to plan your own 12-week year soon. You won't be sorry. Happy Windy Saturday from the farmhouse, friends. Week 2...here we come! ❤️?❤️ I told you that I'd be sharing a bit about our financial journey over the next few weeks. I just almost had a big post complete about my life as a people-pleaser when the electricity flashed due to the thunderstorm and I lost half of it. So I decided maybe it wasn't time to share all of that this evening. Instead, I thought I'd give a little explanation about what Dave Ramsey refers to as "sinking funds" and how we use them here at the farmhouse. Three words. Or two words and a number. Capital One 360. I first read about Capital One 360 on a Dave Ramsey Facebook group that I'm a member of. Someone asked if there was a good savings program online that could be used with sinking funds. Several members commented about Capital One 360, so I decided to try it out. And I absolutely LOVE it.

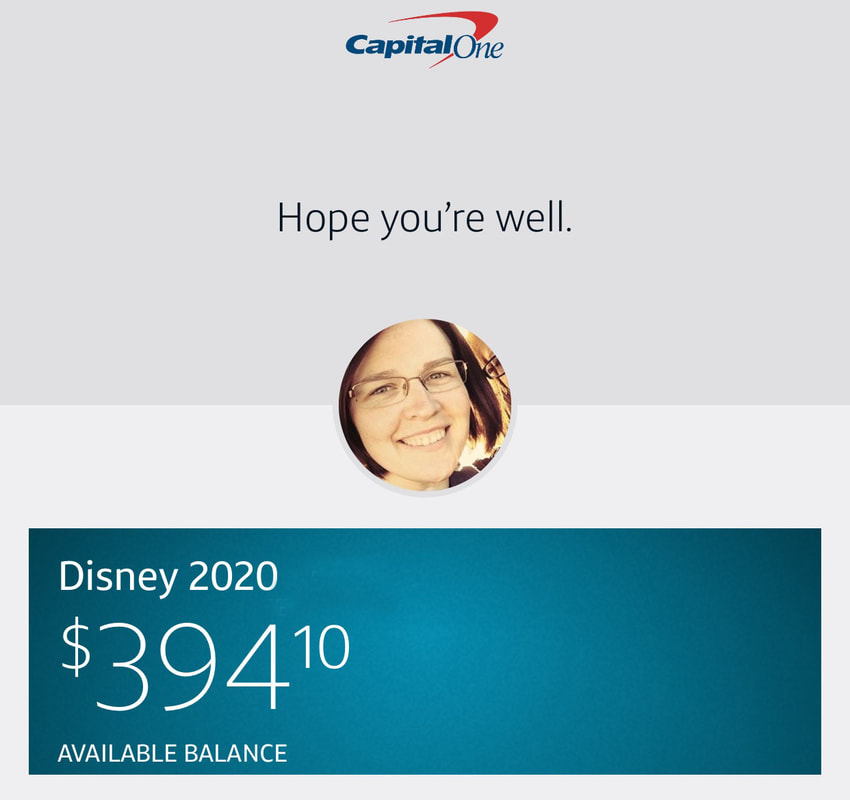

We have it set up to withdraw $30 a month right now from our checking account and just put it into the Disney account for the trip we have planned for 2020.

When we're done with the debt snowball, we'll add more than $30 each month to be able to pay cash for the trip. Some of our other accounts include "house repairs", "new car", "annual taxes", "hunting trip" and a savings account for each of the girls. Some of these accounts get a specific amount added to them weekly, some twice a month, and some monthly. At this point, we don't even think about the debits. They come out on payday and since they are already taken out of our budget, we don't even miss them. An added bonus is that Capital One is doing all of the work for us...every single month. So that's how our sinking funds work. You can have up to 25 separate "line items" on Capital One 360, so as you can imagine, the savings possibilities are endless. ❤️🏡❤️ Over the last several years, we have tried to dig ourselves out of debt.

Last year, we bought a 2004 Bonneville (named Dave) and planned to sell our loaded GMC Yukon. The Yukon didn't sell right away. Then the Bonneville started having some issues and a few times over the last year, I've had to resort to driving the Yukon again. We have now named the Yukon "Ramsey". "Dave" was out of commission for a little while...needing some work that ended up costing us just shy of $500. "Ramsey" needed some work on the air conditioner. As in, we had no AC. During the hottest three weeks of summer. We were driving the loaded Yukon with the windows down, on gravel...sweating our behinds off, trying to wait to get the air conditioning fixed until we closed on the house. Eventually, we bit the bullet and got it fixed. Just in time for us to start driving "Dave" again. Ah, life. ANYway, I thought it might be a time for a little update on the ol' debt snowball. We have had to make LOTS of changes and additions and deletions from the snowball over the last year, with changes to our income and our expenses. With the sale of the old house finally going through last week, I was able to do some extra work on the budget and get the snowball set back up with all of our new information in there. When we decided to buy the farmhouse instead of buying land and building, the debt snowball began to roll much more quickly! As of right now, with NO extra payments, except the snowball we have already started, we'll be debt-free, including the house in eight years. Eight years. You guys. Even if we stick to this exact plan and don't pay any extra on the snowball, Harlee will be barely graduated from high school and we will be debt-free. I'm telling you...the snowball works. With some planning and self-control, you too could be debt-free. If you're interested in hearing more about how the Newkirks "tell our money where to go", keep an eye on the blog in the next few weeks. ❤️🏡❤️ Well, it's almost July. Just crazy, in my opinion. The way that time flies when you grow up. Must be all that "adulting". ANYway, I thought this morning I might share a bit of our financial journey and how some of it has changed through the house-selling and house-purchasing process. We started practicing Dave Ramsey's financial principles about five years ago pretty heavily. We read the book "The Total Money Makeover" and it really inspired us to make better financial decisions. At that time, we had no credit card debt, but we did have a mortgage, two car payments, tons of medical bills, and the dreaded student loans. We started to pay things off with a vengeance, using Dave's debt snowball method. This is where you line all of your debts up, smallest to largest balance, and start attacking the smallest debt with any extra cash that comes in. We made good progress, until baby #3 was born. Miss Mattie's birth brought more medical bills and since I was unable to schedule photography sessions for that first six weeks, we really struggled.

Soooooo...we have been climbing back out of debt over the last few years. Last year, we made the decision to sell our loaded Yukon and buy an '04 Bonneville. The girls and I named the car "Dave" as a reminder that every time we are crunched into this car, we are sacrificing by not having that huge payment and putting that money on debt instead. And then...the Yukon didn't sell. And then...it needed tires. And a tune-up. So we did those things. And it's still sitting in my driveway. A few days ago, Dave started making a funny noise.

And the transmission started slipping. And I couldn't even get up to 50 mph on the highway. So Dave is in the driveway now and we are driving the Yukon...who I've kindly named "Ramsey". When I fired it up yesterday to run the girls to town, we realized that the air conditioning isn't working in Ramsey. Naturally. We have been paying on our house for almost eleven years now. We have paid the mortgage down quite a bit. When we sell, we hope we will be able to pay off Ramsey, pay off that measley credit card, and put the down payment on the new house. And then, we are back to gazelle intensity. Our goal is to have everything, including the farmhouse and student loans, paid off in ten years or less. Ten years. As Dave says, we are "sick and tired of being sick and tired." I can't wait to share our financial freedom story with you as it unfolds! It's coming! |

Archives

January 2024

Categories

All

|

RSS Feed

RSS Feed