Like LITERALLY a week and a half ago, our checking account was OVERDRAFTED by over $1,000. True story. I had gone into the ol' Dollar General to grab a few gifts for the girls' friends. I went up to pay and when I ran my debit card, it was declined. "What!?! That can't be right. Try to run it again." Declined. Again. Sure enough, I pop open my banking app on my phone and we are in the hole...like WAY in the hole. But why? We track our spending and I watch the bank account like a hawk. So what had happened that day that put us in the red??? Well, when two mortgage payments come out two days before pay day, THAT can be an issue when you stick to a zero-based budget every month (in other words, when you budget for and spend every dollar, in order to pay down debt). So I went through that entire evening and the next morning feeling sick, just waiting for the bank and our mortgage company to open so I could make some phone calls. Our bank was very understanding and said they would wait to hear from me after I talked to the mortgage company. When I finally got through to the mortgage company, the sweet lady on the other end of the line was very confused because we had never been late on a payment. In fact, we were running a month ahead. She couldn't understand why the payment would have auto-drafted twice. So she started scrolling through the previous months. And then...she saw it. Because we had paid a little extra each month, it had added up to a whole extra payment this month... and that whole extra payment went in two days before it was supposed to, which had put us a little bit too early on our payment schedule... which in turn caused the computer to put our ENTIRE payment amount on the principal, as opposed to counting as our payment... SO the mortgage company had auto-drafted our December payment in addition to the one we had already paid because it looked like we hadn't paid! They fixed it and refunded it (two days later), but it was a stressful few days there! But at least there was a logical explanation. I would love to go explain to the Dollar General clerk exactly what happened because I'm sure he thought I was ridiculous trying to look at my bank account right then and there and over-explain the reason my card was declined. Maybe he'll read my blog. 😉 ANYway, now that I've gotten that off my chest, let's talk about how Mr. Farmhouse and I set up our annual financial goals, our debt snowball, monthly budget, and spending tracking. Debt Snowball The first piece of the puzzle that I'm going to talk about is the debt snowball. I've mentioned this before, but I'll do a quick review for new readers. The debt snowball is based on the work of Dave Ramsey. You take all of your debts and you line them up from smallest balance to largest balance. Interest doesn't matter and monthly payment doesn't matter. It's all about small victories in this scenario...the motivation that comes from a little success. As you pay off the smallest debt, you take that monthly payment and "roll" it into the next payment. I really don't like to talk about the specifics of finances, but I will tell you that we have a large amount of debt. Some of our debt includes:

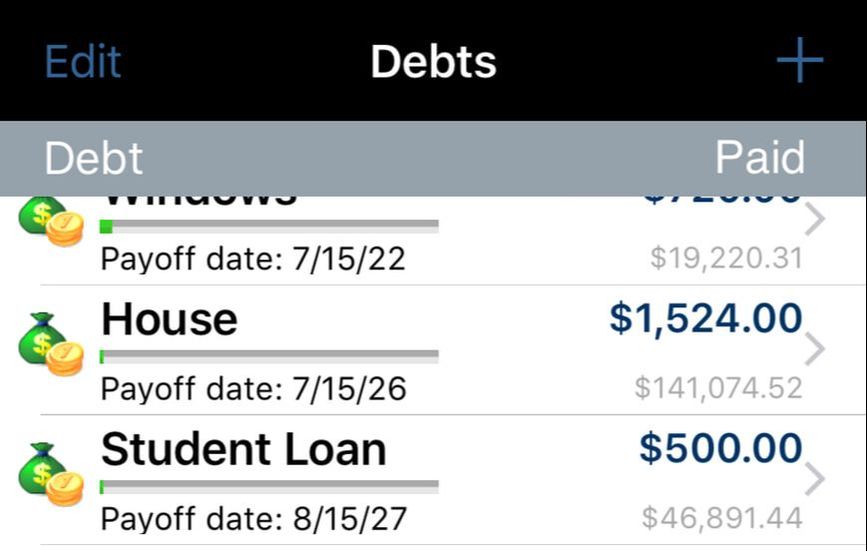

Just this, without the random little medical bills and the two credit cards we still need to pay off, is a pretty daunting amount. However, with the debt snowball, we are making big progress each month towards paying it down.

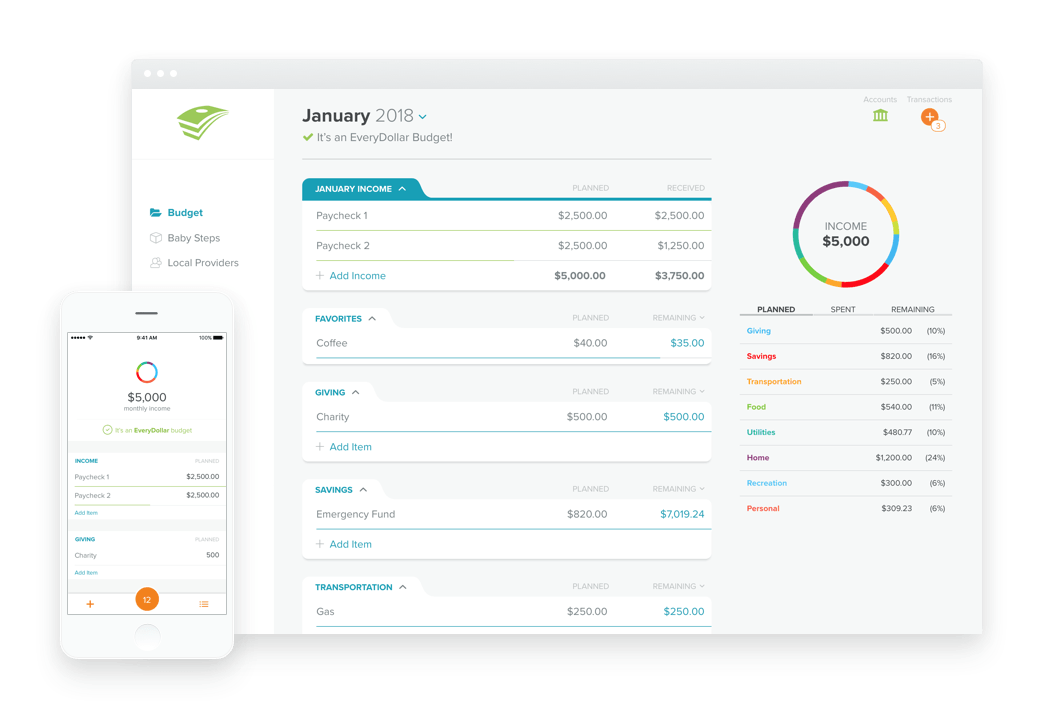

But as you can see, the house and student loans will be our last two debts that need to paid off and without ANY extra money thrown onto the snowball, we'll still be completely debt-free in less than ten years. So I use the snowball app to let me know how much needs to be paid on each debt monthly and those payment amounts fit into our monthly budget. Monthly Budget & Spending Tracking For our monthly budget, we use a free web-based software and app called EveryDollar. We build our budget every month on the computer, but we mostly track our spending using the app. The app syncs across all devices and the web, so it's pretty handy for a husband & wife team who hardly ever gets to sit down and talk about income and expenses. If you are just starting a new budget, I would first take a piece of paper and write down every single expense you have each month. Use your debt snowball to track your monthly debt payments, write out every utility amount, any insurance costs, groceries, fuel, home & car maintenance savings, other savings, charitable giving, childcare, costs associated with pets, business expenses, cash for spending on "fun" (Sonic drinks, in my case!), and anything else you can think of. After you have all of those items written down, start building your budget on EveryDollar. You'll need to write down expected income sources and amounts, as well as expected categories and amounts for expenses. Your online EveryDollar budget will look similar to this sample screenshot below.

Because we get four different paychecks each month, I divide our expenses up and pay them on those four days. We also take our "fun money" out of the bank on those days and account for daycare/preschool expenses, as well as putting money into various savings accounts using sinking funds, which I explained in THIS BLOG POST last year. I write out every expense on the planner. Most of them are automatic withdrawal, which means after I write them out on the calendar, I don't have to think about them again. If they're not automatic, however, I set up the payments to come out on the correct day or I write out the checks and date them to be sent when the correct pay period rolls around.

In terms of tracking other expenses, Mr. Farmhouse and I both use the EveryDollar app to track what we spend each month. We used to be good about putting each expense in right when we spent it. However, over the last few months, we have been tracking a few days worth of receipts in one evening. We're planning to go back to the daily tracking in January though! Those small expenses sure add up when you're not being cognizant of them! Annual Financial Goals The last little piece of the puzzle is to set some annual financial goals. We have found that if we sit down together in the end of December and set some financial goals for the following year, it can help to frame our year, financially speaking. A few examples of our past goals have been:

If we want to be able to give and live the way we want to in the future, we HAVE to be intentional right now...today...this year.

We've had times where we get to the end of the month and wonder where in the world all that money went. It's no way to live! When you're not being intentional with your spending, not only are you missing the opportunity to make progress on your debt snowball, but you're also missing out on that feeling of peace and freedom that comes from knowing where your money goes each month! Not to mention, the fact that these money conversations with your spouse are good for your marriage! So today...think about your financial goals for 2019. Budgeting & Planning here at the Farmhouse today, Hannah ❤️🏡❤️

0 Comments

I have so many wonderful memories of Christmas morning as a child. There was the year that we woke up to 10-speed-bikes sitting in front of the tree, surrounding the rest of the gifts for my little brother and me. There was the year that it was snowy and cold and after all the gifts were opened, we both got carried outside with our eyes closed to find the playhouse they had ready for us. In fact, Mr. Farmhouse and I used that playhouse as our chicken coop until just last year when we moved to the farmhouse. There was the year that he and I peeked at our gifts and our two "big gifts" were missing on Christmas morning. My mom had saved them for last and had wrapped them up with our parents' names on the tags. We were trying to play it cool like we didn't know they were missing, because we didn't realize they knew we had sneaked out to the shop to look...lesson learned! Even into adulthood, we have always been provided with everything we ever dreamed of, so naturally I have wanted to provide the same feeling for my own girls. However, we have some financial goals that we are working towards to be able to provide for them later in life...in high school when they need a vehicle to drive, to help them with college expenses, and of course, when they get married and start having children. Going into debt or dipping into savings at Christmastime is tempting, but after working so hard for an entire year to save and work the debt snowball, we don't want to lose our progress at the end of the year because of gifts.

You guys.

I cannot even tell you how amazing the process has been. The girls couldn't even think of three items for each category. They were sitting together at the dining room table as they tried to think long and hard about what they truly needed and the conversation they were having warmed my heart. H: I can't think of anything for "something I need". I don't think I need anything. C: I put an electric toothbrush because mine broke a few weeks ago. H: You know, I will be needing a new softball glove this year. I'll put that on there. The girls are completely aware that we would buy toothbrushes or softball gloves during other times of the year, but instead of using that gift slot for something else, they both decided to use it to replace items that are worn out or too small. I was able to shop for the gifts without breaking the bank and literally all in one night (Black Friday with my sis-in-law!). They will each get stocking stuffers and one small gift from Santa and that is IT. The tree is still pretty. The farmhouse is still cozy. The magic of the season is all around us. With four gifts each. I can't wait to see their faces on Christmas morning. Happy December from the farmhouse, friends. ❤️🏡❤️ Hello there and welcome to Week 2 of the Farmhouse654 Christmas Countdown!

Last week, we focused on getting organized before we begin our journey to a peaceful holiday season with our families! We divided our home into eight zones and worked all week through the deep-cleaning process for Zone 1. At the farmhouse, this was my Living Room & Entryway. I started the week by decluttering any shelves and drawers in the living room...I went through our DVDs and purged anything we don't watch, cleaned out a few drawers that had acquired some junk, and minimized a few decorations on the flat surfaces. After a crazy week of parent-teacher conferences and the first slumber party in the farmhouse, I used my Friday off school to finish up Zone 1 by deep-cleaning from floor to ceiling...dusting, cleaning the windows, and making the floors shine. If you didn't get to join us for the Week 1 challenge, just try to squeeze both of the first two weeks in this week! Our week 2 challenge is to think about our giving. You can print my Week 2 Planning Printable here. This week, we are focusing on the friends and family members we would like to give gifts to this year. We want to be intentional with our giving! This year for the girls, we are going to do four main gifts... 1. Something they want, 2. Something they need, 3. Something to wear, and 4. Something to read. We're also going to buy a few "family experiences"...zoo passes, a Royals game, and gift cards to some of our favorite restaurants. Thanks to this list, coupled with the fact that we had a Christmas sinking fund (using CapitalOne 360 that I talked about in my blog post a few weeks ago), I am almost finished Christmas shopping. This week, make a list of who you need to buy for, any gifts you might have already, and ideas of what you would like to purchase or make over the next several weeks. The second part of our challenge this week is about how we can give to others during this season. Mr. Farmhouse and I do this in a few different ways that I've outlined on the Week 2 Challenge printable. Start thinking about how you can give back! Finally, we are starting work in Zone 2 this week! My Zone 2 is my Kitchen & Mud Room! These two rooms will be a bit more challenging than the Living Room was! I still haven't felt "settled" in the Mud Room since we moved into the farmhouse three months ago. I'm hoping to change that feeling over the next week by breaking the process up into manageable tasks and tackle those two rooms! I hope and pray that you are already feeling a little more peaceful about the upcoming holiday season! Let's not get bogged down with the hustle and bustle of the holiday season! Let's take a moment and enjoy the process of getting us to this special time of year! Happy New Week, friends! Much love to you and yours from the farmhouse! ❤️🏡❤️ If you're just catching up with the Farmhouse654 Christmas Countdown, feel free to join the Facebook group HERE and print out the Planning Calendar and Week 1 Checklist HERE. Christmas Countdown Blog Posts Week 1 A little over a year ago, we decided to take the plunge and buy an older car and sell our loaded Yukon to get out of debt faster.

We found a 2004 Bonneville at our local car lot and named him “Dave”. Dave was great. He was a one-owner vehicle that had mainly been driven on the highway back and forth to the city each day. He had leather seats and enough room in the backseat that the girls wouldn’t be completely squished when we drove anywhere. We were giving up heated seats that worked, a DVD player, and lots more room in the name of better gas mileage and debt-reduction. The Yukon didn’t sell right away, so it sat in our driveway for a few weeks. This was just enough time for us to realize that Dave had some problems. When I was driving to work, about the time I hit 60 mph, Dave would start shaking uncontrollably. To fix this problem, I drove 59 for a few weeks. By that time, we were able to afford a few new tires and that seemed to help. A week or two after that, Dave started having some transmission issues. So we took him to the mechanic’s shop. Thank goodness we still had the Yukon. By this time, it was almost comical that we had two vehicles to care for and no less debt than we started with. So as sort of a joke, I named the Yukon “Ramsey”. We got Dave up and running again, $421 later. So I listed Ramsey for sale again on Facebook. I didn’t drive Ramsey for a few weeks, until I needed it to haul a piece of furniture out to the new house. I started Ramsey’s engine in late June, and realized that something was wrong with his air-conditioning. Seriously. So I took down the “for sale” listing and we made an appointment to have the air conditioning fixed. The AC just needed a charge. Only $125. After getting that taken care of and using Ramsey to haul things out to the farmhouse when we moved, Mr. Farmhouse and I decided it was time to tell Ramsey goodbye forever and start driving Dave full time. By the time school started, I had been driving Dave again for a few weeks. We were going to take Ramsey to CarMax and get rid of him once and for all over one weekend in late-August. That Friday, Dave started making a funny noise on the way to school. The RPMs would fly up and I started to feel a catch when I tried to accelerated. It got worse and worse. So back to the shop with Dave. We put the sale of Ramsey on hold...again. I got used to driving Ramsey again. The girls got used to having the DVD player again. I got used to the heated seats when my lower back was bothering me at the beginning of the school year. And then one morning, I pushed the button to open the back hatch and it didn't work. Come on, Ramsey! Sure enough, something was wrong in the power lift gate and we needed to take it in to the shop to get it fixed. But Dave was in the shop. So we would just live with it. At this point, we have figured out that Dave is probably not worth the money we paid for him and the Ramsey is probably not going to get sold either. We'll just cut our losses, use the debt snowball to pay Ramsey off soon, and drive them both until they physically die. Last weekend, the girls had a few friends in Ramsey with us as we drove to a volleyball tournament. Now that we live on gravel, neither vehicle is ever clean. I pushed the button to spray windshield washer fluid on the back glass and the two girls in the third row seat started saying, "What is that? Something is dripping! I'm getting wet!" Sure enough...somehow the windshield wiper fluid was spraying into the backseat. I made a mental note to have Mr. Farmhouse check that little situation out after church the next day. Several minutes later, I accidentally hit that button again as we were driving down the road. But no water this time. Instead, I heard the familiar click and warning sound that the back hatch was opening. Seriously. The windshield wiper fluid button had made the power lift gate unlatch. I admit, I laughed. What else do you do? So it seems Dave and Ramsey will both be in the Newkirk family 'til death do us part. ❤️🏡❤️ It was my dream to have a farmhouse porch swing. The girls and I would sit out there and swing and visit about the day. I would get up early in the morning and sit on the swing with my coffee and Bible for my daily "Jesus time". Mr. Farmhouse and I would sit on the porch swing and watch the kids play out front, as we waved to the cars that drove by. It was going to be wooden and "farmhouse-y" and painted a gorgeous shade of white. It would be hanging from the ceiling of the front porch and lined with beautiful outdoor accent pillows. And then...Facebook read my mind and sent me an advertisement for this.

So I added it to my cart online and found out I would get free 2-day shipping. And when I clicked into my cart to checkout, the truth was revealed. The tan swing was not on sale. The red swing was not on sale. The camo swing was on sale.

Mr. FH: What are you buying? Me: Oh, I was looking at a swing for the porch, but I think I'll wait. Mr. FH (looking over my shoulder): Wait...is that camo? Me: That's one of the options, but I think I'll just wait. Mr. FH: Is that $57??? Me: Uh...yeah, I guess it is. Mr. FH: That's so awesome!

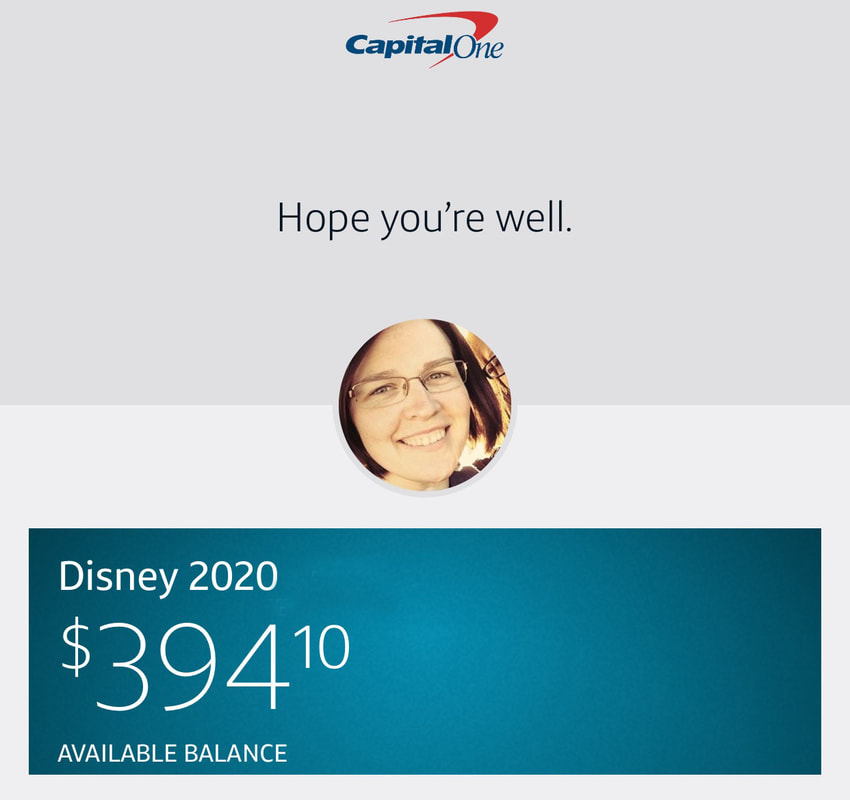

I told you that I'd be sharing a bit about our financial journey over the next few weeks. I just almost had a big post complete about my life as a people-pleaser when the electricity flashed due to the thunderstorm and I lost half of it. So I decided maybe it wasn't time to share all of that this evening. Instead, I thought I'd give a little explanation about what Dave Ramsey refers to as "sinking funds" and how we use them here at the farmhouse. Three words. Or two words and a number. Capital One 360. I first read about Capital One 360 on a Dave Ramsey Facebook group that I'm a member of. Someone asked if there was a good savings program online that could be used with sinking funds. Several members commented about Capital One 360, so I decided to try it out. And I absolutely LOVE it.

We have it set up to withdraw $30 a month right now from our checking account and just put it into the Disney account for the trip we have planned for 2020.

When we're done with the debt snowball, we'll add more than $30 each month to be able to pay cash for the trip. Some of our other accounts include "house repairs", "new car", "annual taxes", "hunting trip" and a savings account for each of the girls. Some of these accounts get a specific amount added to them weekly, some twice a month, and some monthly. At this point, we don't even think about the debits. They come out on payday and since they are already taken out of our budget, we don't even miss them. An added bonus is that Capital One is doing all of the work for us...every single month. So that's how our sinking funds work. You can have up to 25 separate "line items" on Capital One 360, so as you can imagine, the savings possibilities are endless. ❤️🏡❤️

You might remember the first night we slept in the farmhouse, we unrolled and unveiled our mattress-in-a-box that we purchased on Amazon.

We also purchased a foundation on Amazon...spending just $417 total for the whole set. As of last night, we have slept on the bed for a full two weeks, not counting the nights we spent at the lake. I think we have had it long enough to say with confidence that we could not be more happy. On our old mattress (that was 34 years old, mind you), we both had back problems. We hurt often and didn't always wake up feeling refreshed. The first few nights of sleeping on a 12-inch memory foam mattress, I wasn't too sure. It was quite a bit firmer than I expected and I woke up feeling a little sore on the first two mornings. However, I also slept all night on both of those nights. That hardly ever happened with our old mattress. This week at the lake, I was up every single night for hours...tossing and turning, trying to find a comfortable position in which to sleep. We came home last night and Ilanded in bed not feeling well fairly early. I have to tell you...I slept all night (minus the 10 minutes at 3:30 a.m. that Mattie woke up and needed me to help her find her blankie). I still don't feel great this morning, but this mattress provided the restful night I needed. So as an update to the mattress-in-a-box post a few weeks ago. We highly recommend it. ❤️?❤️

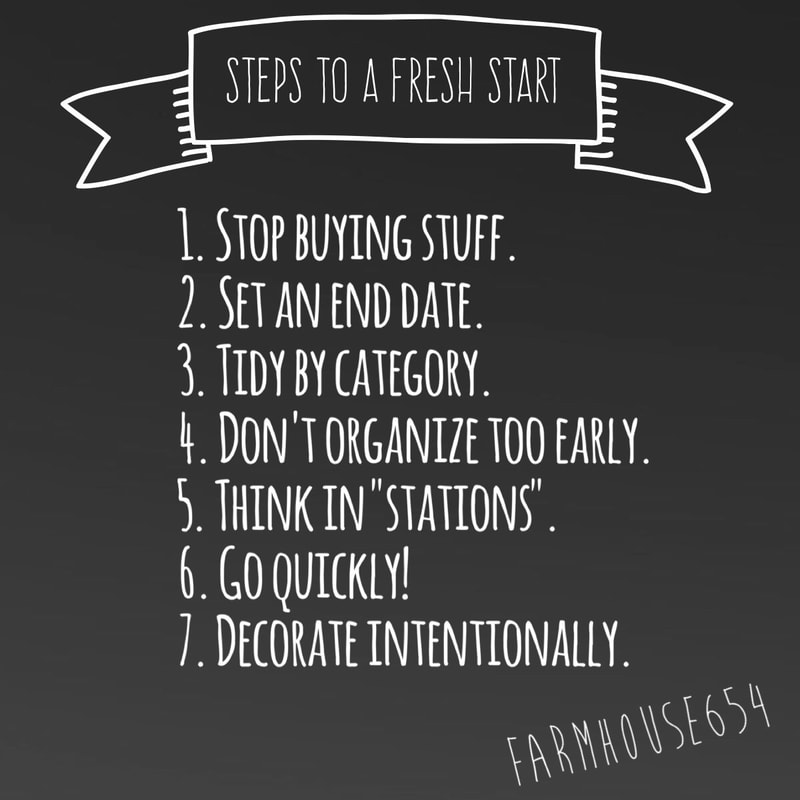

Since moving into the farmhouse and sharing our journey online, I've had so many people contact me wanting a fresh start.

"I am so jealous that you get to start over." "Seeing you put the new house together makes me want a fresh start for my house." "I wish I could empty out our house and start again." This opportunity to go through every single thing we own and make a decision about whether or not to keep it has been pretty amazing. Add to it the fact that I get to decide exactly where it goes in the farmhouse, and I am feeling pretty good about our "fresh start".

For now, just hold off on bringing anything new into your home.

Deal with what you have. There will be plenty of time to buy new things after you've gotten rid of everything you don't love. 2. Set an end date. This one is something that many people don't think about, but it helped me immensely last summer when I went through and did my big house purge and it's helping now as I put the house together. Find a date to work towards and mark it on the calendar. For me, this year, that date is July 25th. We are hoping to take the girls on a little lake vacation starting on the 26th and I don't want to leave one thing in the house undone. I want to leave the house all peaceful and put together so when we come home from vacation, it's still all peaceful and put together. 3. Tidy by category. This phrase is taken directly out of Marie Kondo's book called "The Life-Changing Magic of Tidying Up". By the way, I just looked and the book is on sale on Amazon right now for $9.89!

As I came across any photography-related items in the rest of my tidying endeavors, I put them into a box labeled as such.

I did this with all of my miscellaneous categories and dealt with those boxes when I got to that category on my list. I left a few blank boxes for you to fill in your own random categories, but if you're like me, you'll need more than a few boxes! Feel free to start your own list on another piece of paper or the back! Don't overthink it! 4. Don't start organizing until you're done with several categories. The temptation is there to start putting everything away before you're done with the discarding process. From personal experience...don't do it. Purge first...then organize. Otherwise, you'll get one area completely organized and find something later that would have fit there so much better. 5. Think in "stations". I have started to think about my house in terms of where certain things happen. This has really helped me to get organized and to stay organized (for the most part).

When you begin to think like this, your house starts to organize itself.

Out in the mud room, our beach towels are now housed with the sunscreen & goggles...far away from the bath towels that they used to be stored with in the old house. It just made sense to have them there, instead of taking up valuable room in the bathroom. When you've done enough categories that you feel like it's time to start some organizing, make sure to keep this "station" mindset. 6. Go quickly! Don't think too much! When you pick up an item, ask yourself, "Does this spark joy?" If it does, keep it! No questions asked! If it doesn't spark joy, but it's something you need...keep those things too. Toothpaste doesn't really spark joy for me, but I would sure like my family to continue brushing their teeth! Go with your gut instinct about things. Try not to think in terms of what you "might need someday". If it's something you could borrow or replace pretty inexpensively if you ever "need" it again...throw it out! Donate it, trash it, or give it away to a friend. Get it out of your house, as soon as possible! 7. Decorate intentionally. Put your belongings into categories and go through each category, ruthlessly purging items that you don't love or need. Organize the leftover items into functional stations throughout the house. Then...decorate! Keep the decorations you love and start to think about what other items you might add to your decor collection. This isn't something you have to do immediately. I prefer to check Hobby Lobby every month or so and scour their clearance aisle for things that spark joy for me. I hardly ever spend over $5 on any sort of decoration for my home. And when I do, it must be a joy-sparking item that I know will fit perfectly into my home!

These two items were joy-sparkers the moment I laid eyes on them!

The United States map that now hangs in the playroom cost me $39.99 on our mini-vacation to Pawhuska, Oklahoma and it was so worth that price! Every time I look at it, my heart leaps for joy! In fact, yesterday when I hung it in it's home up in the girls' playroom, I couldn't stop smiling! I feel the same way about my Farmhouse sign from Hobby Lobby. It's $22.50 now on Hobby Lobby's website! I spent $27.00 on it because it was originally $45.00 and I had a 40% off coupon. Again...so worth the price!

Well, it's almost July. Just crazy, in my opinion. The way that time flies when you grow up. Must be all that "adulting". ANYway, I thought this morning I might share a bit of our financial journey and how some of it has changed through the house-selling and house-purchasing process. We started practicing Dave Ramsey's financial principles about five years ago pretty heavily. We read the book "The Total Money Makeover" and it really inspired us to make better financial decisions. At that time, we had no credit card debt, but we did have a mortgage, two car payments, tons of medical bills, and the dreaded student loans. We started to pay things off with a vengeance, using Dave's debt snowball method. This is where you line all of your debts up, smallest to largest balance, and start attacking the smallest debt with any extra cash that comes in. We made good progress, until baby #3 was born. Miss Mattie's birth brought more medical bills and since I was unable to schedule photography sessions for that first six weeks, we really struggled.

Soooooo...we have been climbing back out of debt over the last few years. Last year, we made the decision to sell our loaded Yukon and buy an '04 Bonneville. The girls and I named the car "Dave" as a reminder that every time we are crunched into this car, we are sacrificing by not having that huge payment and putting that money on debt instead. And then...the Yukon didn't sell. And then...it needed tires. And a tune-up. So we did those things. And it's still sitting in my driveway. A few days ago, Dave started making a funny noise.

And the transmission started slipping. And I couldn't even get up to 50 mph on the highway. So Dave is in the driveway now and we are driving the Yukon...who I've kindly named "Ramsey". When I fired it up yesterday to run the girls to town, we realized that the air conditioning isn't working in Ramsey. Naturally. We have been paying on our house for almost eleven years now. We have paid the mortgage down quite a bit. When we sell, we hope we will be able to pay off Ramsey, pay off that measley credit card, and put the down payment on the new house. And then, we are back to gazelle intensity. Our goal is to have everything, including the farmhouse and student loans, paid off in ten years or less. Ten years. As Dave says, we are "sick and tired of being sick and tired." I can't wait to share our financial freedom story with you as it unfolds! It's coming! |

Archives

January 2024

Categories

All

|

RSS Feed

RSS Feed