|

Over the last several years, we have tried to dig ourselves out of debt.

Last year, we bought a 2004 Bonneville (named Dave) and planned to sell our loaded GMC Yukon. The Yukon didn't sell right away. Then the Bonneville started having some issues and a few times over the last year, I've had to resort to driving the Yukon again. We have now named the Yukon "Ramsey". "Dave" was out of commission for a little while...needing some work that ended up costing us just shy of $500. "Ramsey" needed some work on the air conditioner. As in, we had no AC. During the hottest three weeks of summer. We were driving the loaded Yukon with the windows down, on gravel...sweating our behinds off, trying to wait to get the air conditioning fixed until we closed on the house. Eventually, we bit the bullet and got it fixed. Just in time for us to start driving "Dave" again. Ah, life. ANYway, I thought it might be a time for a little update on the ol' debt snowball. We have had to make LOTS of changes and additions and deletions from the snowball over the last year, with changes to our income and our expenses. With the sale of the old house finally going through last week, I was able to do some extra work on the budget and get the snowball set back up with all of our new information in there. When we decided to buy the farmhouse instead of buying land and building, the debt snowball began to roll much more quickly! As of right now, with NO extra payments, except the snowball we have already started, we'll be debt-free, including the house in eight years. Eight years. You guys. Even if we stick to this exact plan and don't pay any extra on the snowball, Harlee will be barely graduated from high school and we will be debt-free. I'm telling you...the snowball works. With some planning and self-control, you too could be debt-free. If you're interested in hearing more about how the Newkirks "tell our money where to go", keep an eye on the blog in the next few weeks. ❤️🏡❤️

0 Comments

I can't even believe I'm saying this. It's done. The closing papers are signed. We have a new address. The farmhouse belongs to us. Yes, we have been living here for a few weeks now. Almost all of our belongings are already moved over and put away. It has felt like "ours" for a little while already. But this long process of inspections and appraisals and repairs and painting...it is over. We bought our forever home today. And soon, we will sell our home of eleven years. It didn't happen like we thought it would. In fact, the sale of our other home isn't even complete yet. In May, when this whole process started, if we had known that we wouldn't be closing on the farmhouse until August 2nd, I would have laughed and said, "No way." If you would have said that I would have to reschedule my very first teacher meeting for the 2017-2018 school year to go sign papers, I would have said, "Not happening." But here we are. In a few days, we'll build a wall to create an official fourth bedroom. We'll add a second bathroom upstairs. We'll tear out and rebuild Mattie's closet. But not yet. For now, we'll just enjoy today. The day that the farmhouse became our home. Farmhouse, sweet farmhouse. ❤️🏡❤️ Home, sweet home.

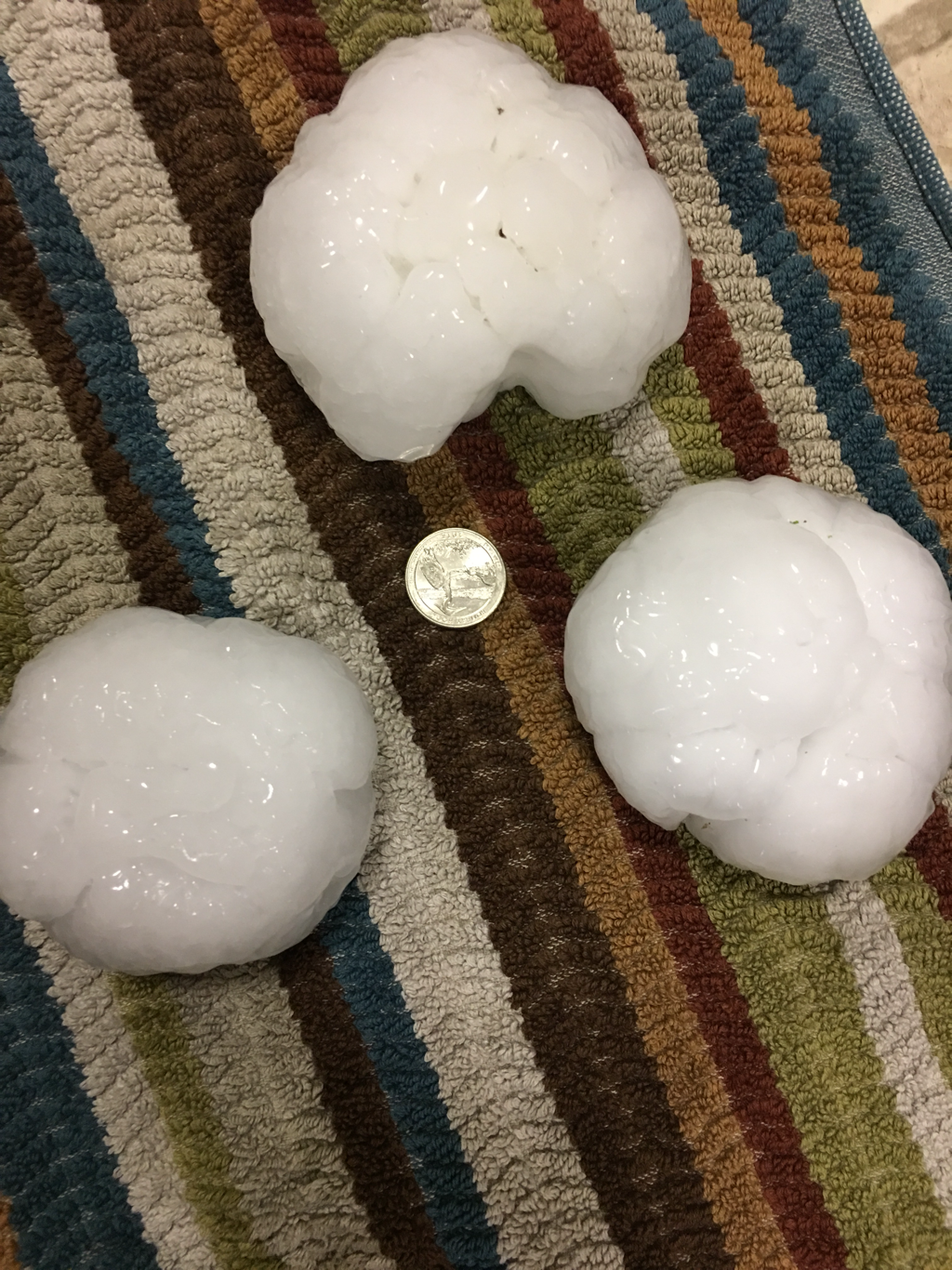

Everything was moving along so smoothly with our house sale and our house purchase. Until last week. We had originally planned on closing on both and sale and purchase on June 16th. We had started to pack our life away into tubs and had started putting less-used furniture into a large enclosed trailer in our driveway. And then we got a phone call about about the possibility that the closing date was actually July 1st. With further investigation, that seemed to be the closing date on several pieces of paperwork making this whole process work out. In the meantime, we were notified of several loose ends that needed to be tied up to make sure that things could progress as they needed to. Somewhere along the line, someone neglected to order an appraisal of our current home. There were a few issues on the title work of our house that needed to be cleaned up. Our buyers needed to make some repairs to their current home and their appraiser needed to come back out and inspect their work. And then...hail. That's a quarter between those three softball-sized pieces of hail.

On May 27th, in the midst of our preparation to close, we had a huge hail storm that tore up our current property. We need four new roofs...the house, the detached garage, and both of our big barns. We need some new shutters, new fascia, and new gutters. So really, the delay that I was frustrated about to start with has been kind of helpful. We are waiting on the official report from the adjuster and then we will get to work making these repairs. So June 30th, it is. Two. More. Weeks. |

Archives

January 2024

Categories

All

|

RSS Feed

RSS Feed