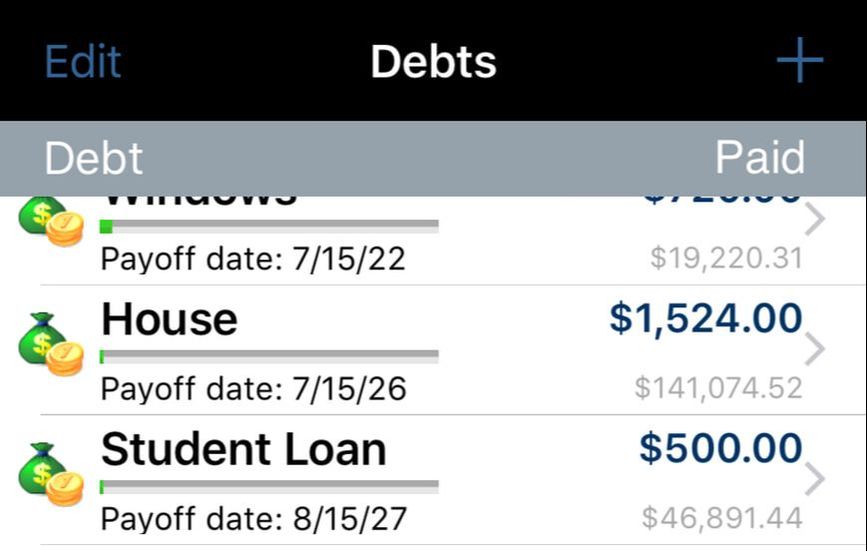

Like LITERALLY a week and a half ago, our checking account was OVERDRAFTED by over $1,000. True story. I had gone into the ol' Dollar General to grab a few gifts for the girls' friends. I went up to pay and when I ran my debit card, it was declined. "What!?! That can't be right. Try to run it again." Declined. Again. Sure enough, I pop open my banking app on my phone and we are in the hole...like WAY in the hole. But why? We track our spending and I watch the bank account like a hawk. So what had happened that day that put us in the red??? Well, when two mortgage payments come out two days before pay day, THAT can be an issue when you stick to a zero-based budget every month (in other words, when you budget for and spend every dollar, in order to pay down debt). So I went through that entire evening and the next morning feeling sick, just waiting for the bank and our mortgage company to open so I could make some phone calls. Our bank was very understanding and said they would wait to hear from me after I talked to the mortgage company. When I finally got through to the mortgage company, the sweet lady on the other end of the line was very confused because we had never been late on a payment. In fact, we were running a month ahead. She couldn't understand why the payment would have auto-drafted twice. So she started scrolling through the previous months. And then...she saw it. Because we had paid a little extra each month, it had added up to a whole extra payment this month... and that whole extra payment went in two days before it was supposed to, which had put us a little bit too early on our payment schedule... which in turn caused the computer to put our ENTIRE payment amount on the principal, as opposed to counting as our payment... SO the mortgage company had auto-drafted our December payment in addition to the one we had already paid because it looked like we hadn't paid! They fixed it and refunded it (two days later), but it was a stressful few days there! But at least there was a logical explanation. I would love to go explain to the Dollar General clerk exactly what happened because I'm sure he thought I was ridiculous trying to look at my bank account right then and there and over-explain the reason my card was declined. Maybe he'll read my blog. 😉 ANYway, now that I've gotten that off my chest, let's talk about how Mr. Farmhouse and I set up our annual financial goals, our debt snowball, monthly budget, and spending tracking. Debt Snowball The first piece of the puzzle that I'm going to talk about is the debt snowball. I've mentioned this before, but I'll do a quick review for new readers. The debt snowball is based on the work of Dave Ramsey. You take all of your debts and you line them up from smallest balance to largest balance. Interest doesn't matter and monthly payment doesn't matter. It's all about small victories in this scenario...the motivation that comes from a little success. As you pay off the smallest debt, you take that monthly payment and "roll" it into the next payment. I really don't like to talk about the specifics of finances, but I will tell you that we have a large amount of debt. Some of our debt includes:

Just this, without the random little medical bills and the two credit cards we still need to pay off, is a pretty daunting amount. However, with the debt snowball, we are making big progress each month towards paying it down.

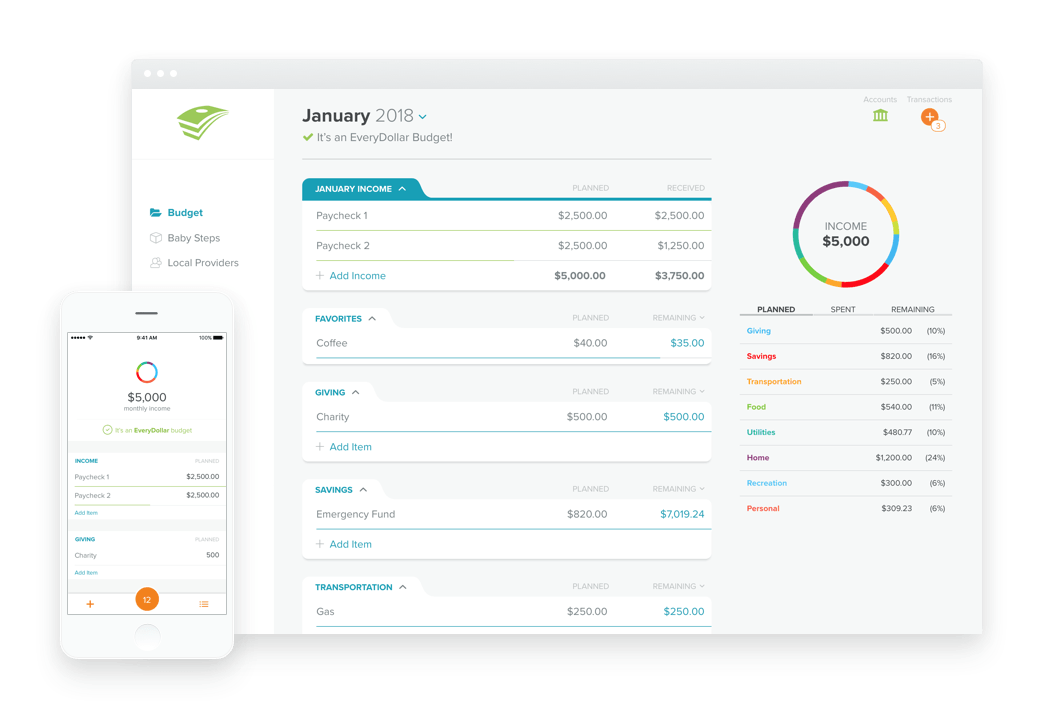

But as you can see, the house and student loans will be our last two debts that need to paid off and without ANY extra money thrown onto the snowball, we'll still be completely debt-free in less than ten years. So I use the snowball app to let me know how much needs to be paid on each debt monthly and those payment amounts fit into our monthly budget. Monthly Budget & Spending Tracking For our monthly budget, we use a free web-based software and app called EveryDollar. We build our budget every month on the computer, but we mostly track our spending using the app. The app syncs across all devices and the web, so it's pretty handy for a husband & wife team who hardly ever gets to sit down and talk about income and expenses. If you are just starting a new budget, I would first take a piece of paper and write down every single expense you have each month. Use your debt snowball to track your monthly debt payments, write out every utility amount, any insurance costs, groceries, fuel, home & car maintenance savings, other savings, charitable giving, childcare, costs associated with pets, business expenses, cash for spending on "fun" (Sonic drinks, in my case!), and anything else you can think of. After you have all of those items written down, start building your budget on EveryDollar. You'll need to write down expected income sources and amounts, as well as expected categories and amounts for expenses. Your online EveryDollar budget will look similar to this sample screenshot below.

Because we get four different paychecks each month, I divide our expenses up and pay them on those four days. We also take our "fun money" out of the bank on those days and account for daycare/preschool expenses, as well as putting money into various savings accounts using sinking funds, which I explained in THIS BLOG POST last year. I write out every expense on the planner. Most of them are automatic withdrawal, which means after I write them out on the calendar, I don't have to think about them again. If they're not automatic, however, I set up the payments to come out on the correct day or I write out the checks and date them to be sent when the correct pay period rolls around.

In terms of tracking other expenses, Mr. Farmhouse and I both use the EveryDollar app to track what we spend each month. We used to be good about putting each expense in right when we spent it. However, over the last few months, we have been tracking a few days worth of receipts in one evening. We're planning to go back to the daily tracking in January though! Those small expenses sure add up when you're not being cognizant of them! Annual Financial Goals The last little piece of the puzzle is to set some annual financial goals. We have found that if we sit down together in the end of December and set some financial goals for the following year, it can help to frame our year, financially speaking. A few examples of our past goals have been:

If we want to be able to give and live the way we want to in the future, we HAVE to be intentional right now...today...this year.

We've had times where we get to the end of the month and wonder where in the world all that money went. It's no way to live! When you're not being intentional with your spending, not only are you missing the opportunity to make progress on your debt snowball, but you're also missing out on that feeling of peace and freedom that comes from knowing where your money goes each month! Not to mention, the fact that these money conversations with your spouse are good for your marriage! So today...think about your financial goals for 2019. Budgeting & Planning here at the Farmhouse today, Hannah ❤️🏡❤️

0 Comments

|

Archives

January 2024

Categories

All

|

RSS Feed

RSS Feed